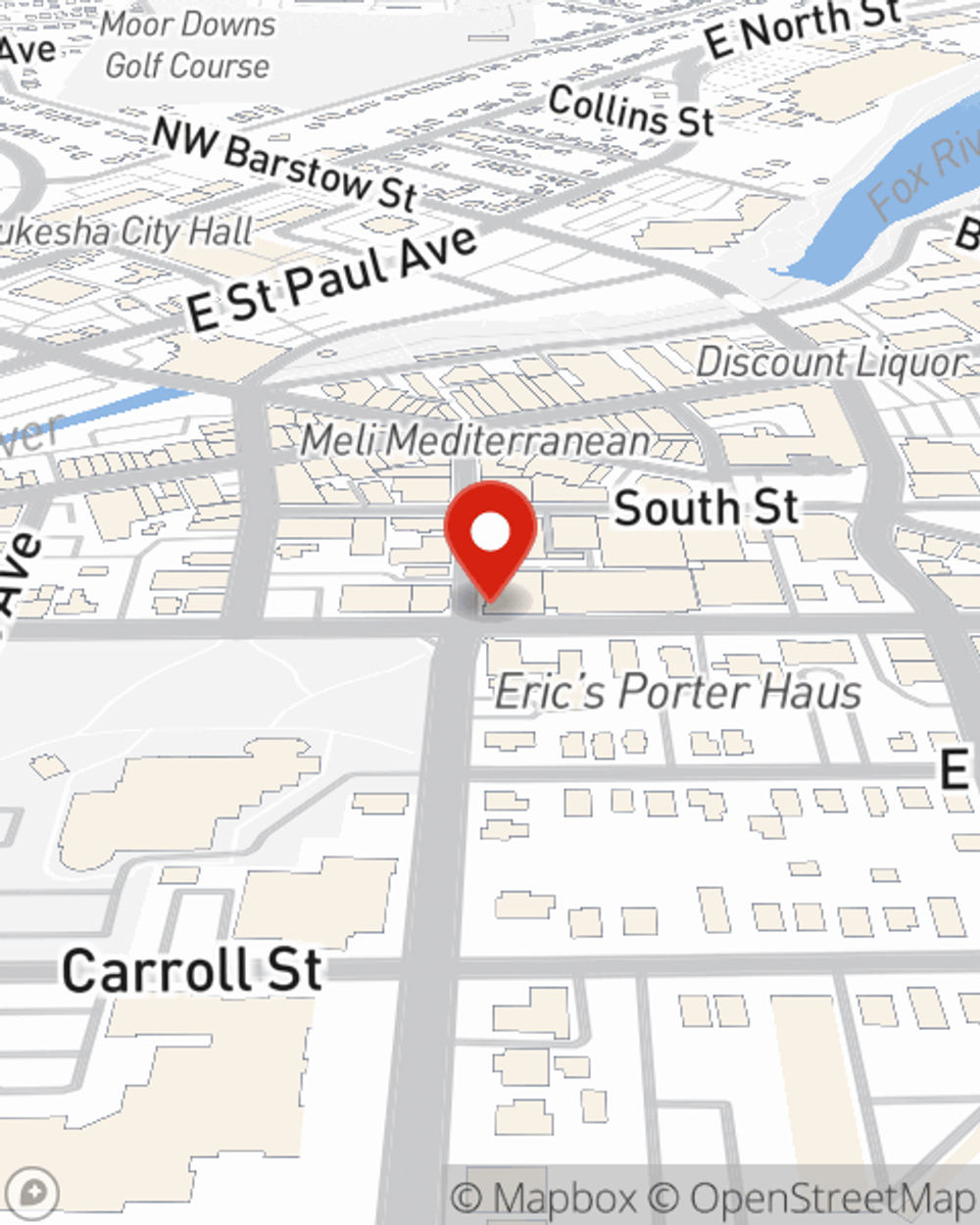

Business Insurance in and around Waukesha

Calling all small business owners of Waukesha!

Almost 100 years of helping small businesses

- Wisconsin

- Illinois

- Waukesha County

- Milwaukee County

- Walworth County

- Washington County

- Lake County

- Cook County

- Waukesha

- Milwaukee

- Brookfield

- New Berlin

- Mukwonago

- Sussex

- Pewaukee

- Delafield

- West Allis

- Wauwatosa

- Elm Grove

- Menomonee Falls

- Michigan

- Minnesota

- Iowa

- Chicago

This Coverage Is Worth It.

Preparation is key for when a catastrophe happens on your business's property like a customer slipping and falling.

Calling all small business owners of Waukesha!

Almost 100 years of helping small businesses

Get Down To Business With State Farm

With options like a surety or fidelity bond, worker's compensation for your employees, business continuity plans, and more, having quality insurance can help you and your small business be prepared. State Farm agent Chris Janet is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does happen.

Don’t let worries about your business stress you out! Contact State Farm agent Chris Janet today, and find out how you can save with State Farm small business insurance.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Chris Janet

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.